i-invest.homestead.com

9.5 Market Crashes

The stock market will drop periodically and is considered a Correction or a Sell-off.

When the drop is more than 20% (relative to the S&P500 Index) it is considered a Crash.

There has been 7 market crashes over the past 60 years, The seventh from the Pandemic

in March 2020. A review of market crashes was published by AARP in June 2020 entitled:

"What I Learned From 6 Market Crashes" by Jane Bryon Quinn

We forget that after crashes, it's too late to sell. That switching to CDs will lock in losses

permanently. That the stock market on average has always recovered and gone higher.

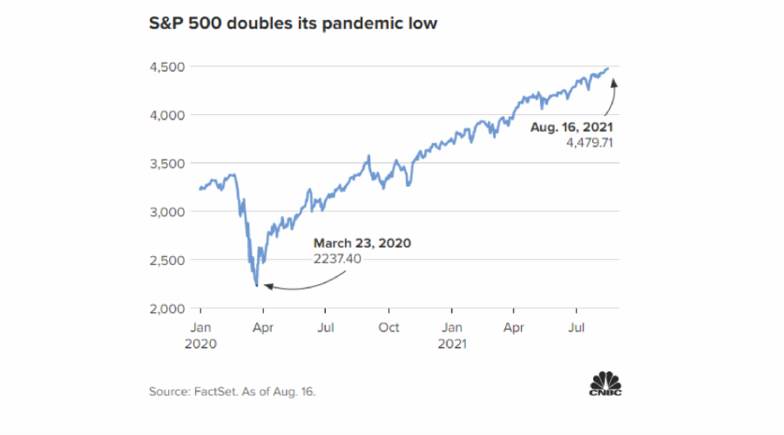

Fastest Bull Market in History as S&P500 doubles from its Pandemic low

The broad equity benchmark has rallied 100% from its Covid low on March 2020. It took the market 354 trading days to get there, making the fastest bull-market doubling since World War II, according to a CNBC analysis of data from S&P Dow Jones Indexes.

While none of this means investors should "sell everything" and hide

in Cash, it does suggest a logical risk management approach.