i-invest.homestead.com

9.10 BEAR VS. BULL MARKETS

| ||||

| ||||

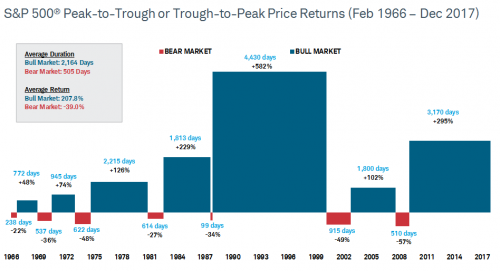

The Schwab Center for Financial Research looked at both bull and bear markets in the S&P 500

going back to the late '60s and found the following:

The average bull market lasted 2,164 days and delivered an average return of 207.8%.

The average bear market lasted 505 days and delivered an average loss of 39%.

Historically the market's upward movement has prevailed over the declines.

Include CASH in your portfolio.

Cash has its short-term use, but don't let that blind you to it's long-term potential as an agent

of diversification in your portfolio.

Cash has a very low correlation to other asset classes, so it offers protection against volatility.

Another advantage, CASH reserves can come in handy in down markets.

With CASH you can buy in when prices are attractively low without having to sell securities at a loss,

if they are also at a low point. So Cash can provide your portfolio with some stability (low correlation, low volatility) and flexibility (to buy new assets without selling old ones cheap)..

How the World's Riches are affected by a Stock Market Sell-Off

Oct 10,2014 - World's Riches lost $70.2 billion

The world’s 400 richest people lost $70.2 billion from their collective net worth last week amid a

global stock sell-off that sent the Standard & Poor’s 500 Index to its biggest weekly drop in two years.

Hedge fund billionaires suffered some of the biggest losses.

John Paulson, founder of Paulson & Co., dropped $1.5 billion after his funds declined as much as

11 percent last month. He controls more than 50 percent of the company’s assets under management.

Elon Musk lost $755 million after his Tesla Motors Inc. fell the most in three weeks Friday after

unveiling an all-wheel drive Model S and driver-assisting tools.

Berkshire Hathaway Inc. chairman Warren Buffett said last week that his investment in struggling British supermarket business Tesco was a “huge mistake.”

Bill Gates remains the world’s richest person with a net worth of $81.8 billion.

The Microsoft Corp. co-founder dropped $2.8 billion last week as the software maker

tumbled 4.5%

Ref: http://www.sfgate.com/business/article/World-s-richest-people-lose-70-billion-5815605.php

Warren Buffett Just Lost Another $1.5 Billion

CNBC 6 :50 AM - 21 Oct 2014

Another day, another $1 billion down the

market's drain. Spare a thought for

Warren Buffett, whose portfolio is not

doing him any favors this week. On

Monday Buffett lost nearly $1 billion on

his third-largest investment, IBM,

after the company posted disappointing

earnings. On Tuesday, Coca-Cola did the

same thing, posting third-quarter revenue

that fell short of expectations and warning

of currency headwinds.

Source: Schwab Center for Financial Research with data provided by Bloomberg.

The market is represented by daily price returns of the S&P 500®Index.

Bear markets are defined as periods with cumulative declines of at least 20% from the previous peak close.

Its duration is measured as the number of days from the previous peak close to the lowest close

reached after it has fallen at least 20%.

In the chart, periods between bear markets are designated as bull markets. Indices are unmanaged,

do not incur fees or expenses, and cannot be invested in directly. Past performance does not guarantee future results.

Bear Markets Generally Occur every Four to Six Years